Highlights of Our Recent Sales

Take a look at some of the headline properties recently sold by Caledonia Bureau. Although we primarily list on Rightmove, we proudly present these featured sales to demonstrate our commitment to exceptional real estate service.

We’ve sold and listed over 1,000 properties, click below to visit our YouTube channel for examples of our work!

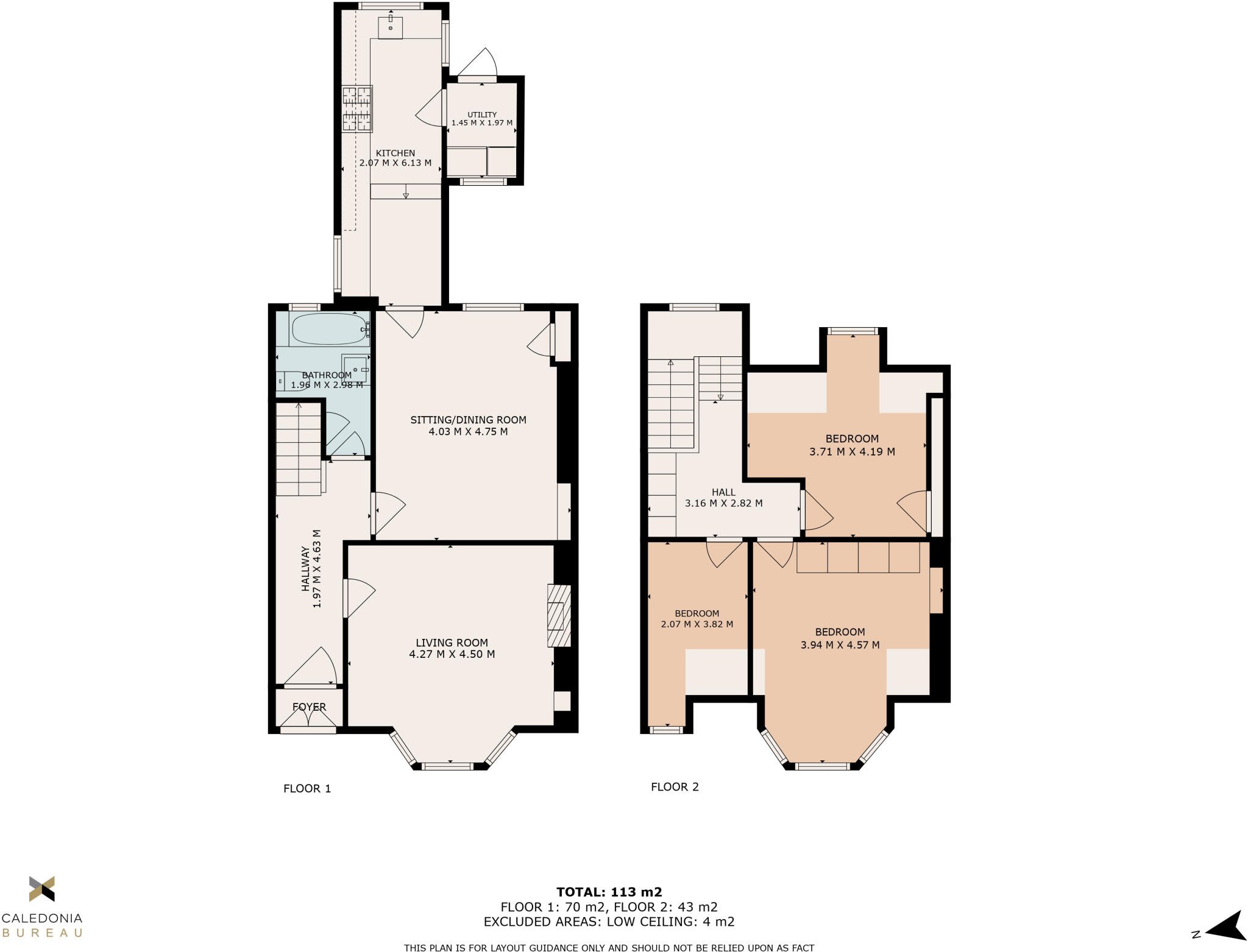

23 Melfort Gardens, Clydebank, G81

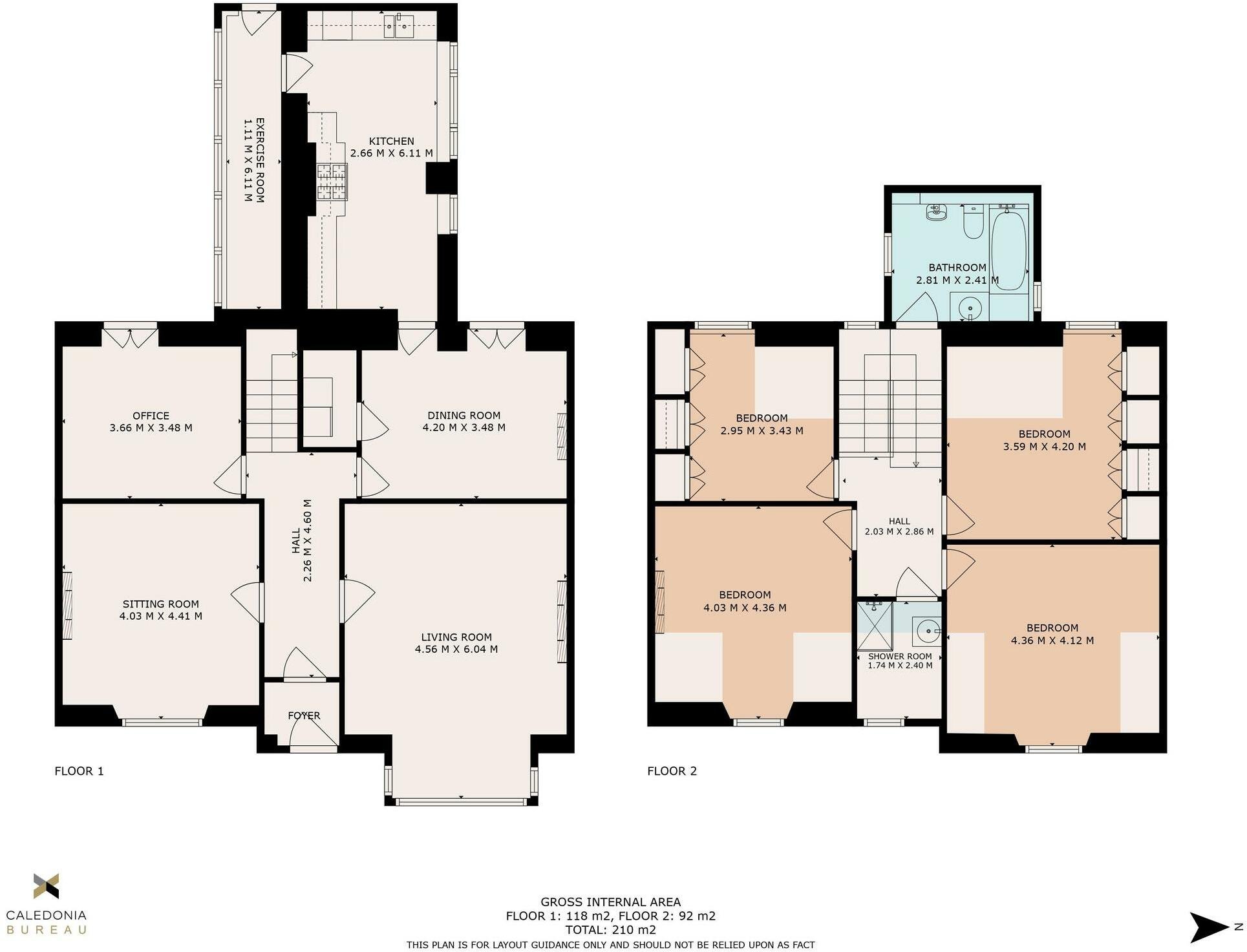

3 Helenslee Rd, Dumbarton, G82

64 Wallace St, Dumbarton G82

13 Cutty Sark Pl, Dumbarton, G82

Rockfort, 154 East Clyde Street, Helensburgh, G84

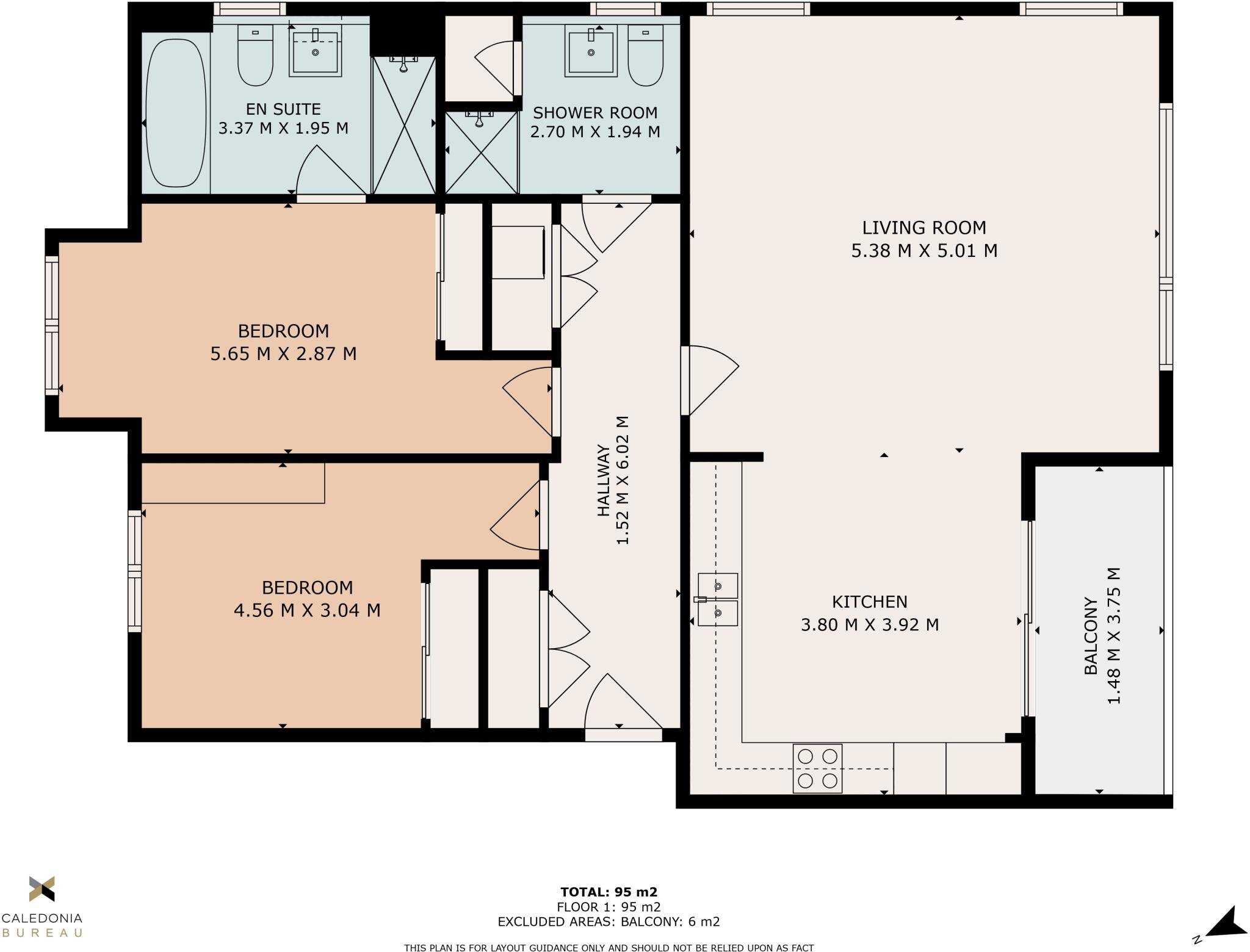

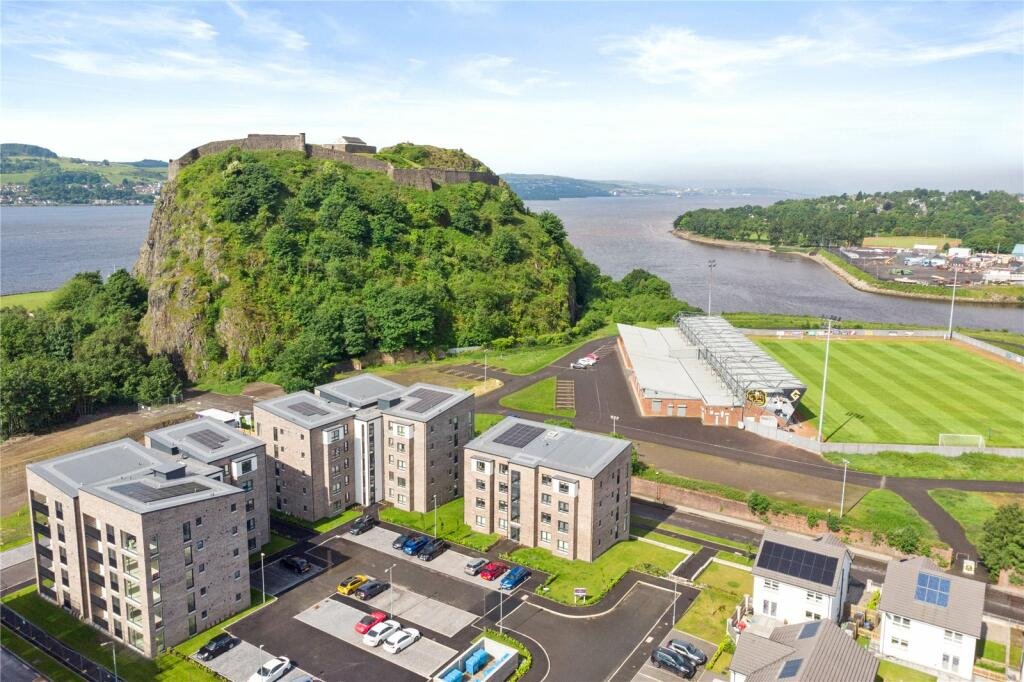

12, 1 Dalreoch Place, Dumbarton G82